Rate SSS Contribution 2023 Here's Guide on How Much You Must Pay as

Here is the Voluntary Contribution SSS 2023 Table and how to check your required monthly contribution as an employee in Philippines.. Annually, the Social Security System releases a payment schedule detailing the required monthly contributions for both employees and employers. Employees are expected to make their monthly contributions either independently or through their employing company.

2023 SSS Contribution Table and Schedule of Payment The Pinoy OFW

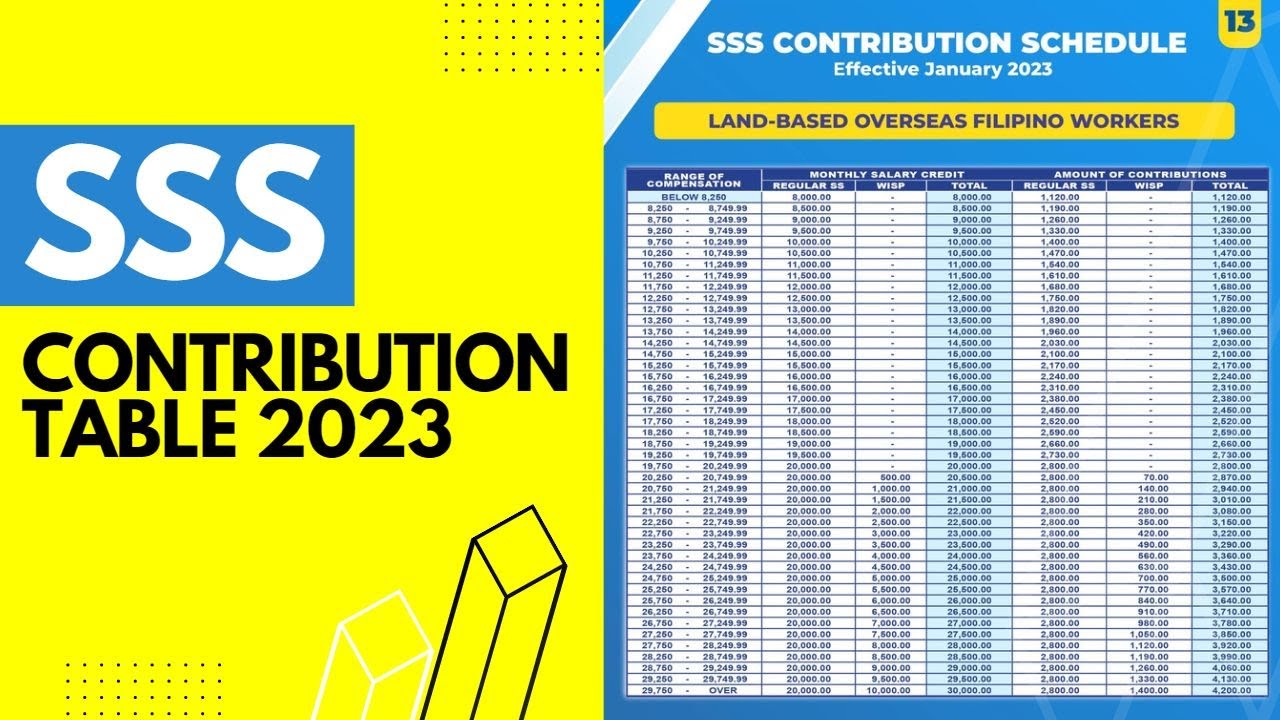

Calculation: Contribution = 11% (Contribution Rate) x 18,000 PHP (MSC) = 1,980 PHP. In brief, calculating the contributions utilizing the 2023 SSS Contribution Table involves determining the MSC (Monthly Salary Credit) based on the revenue and locating the corresponding contribution rates.

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

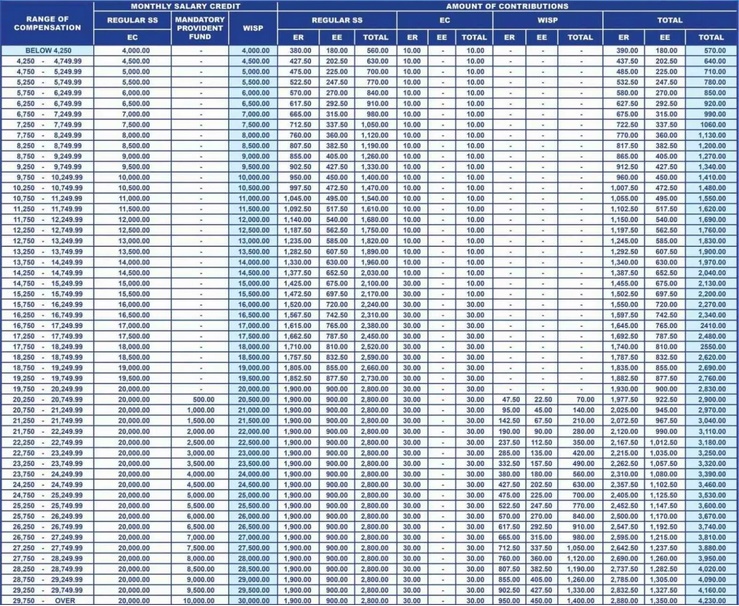

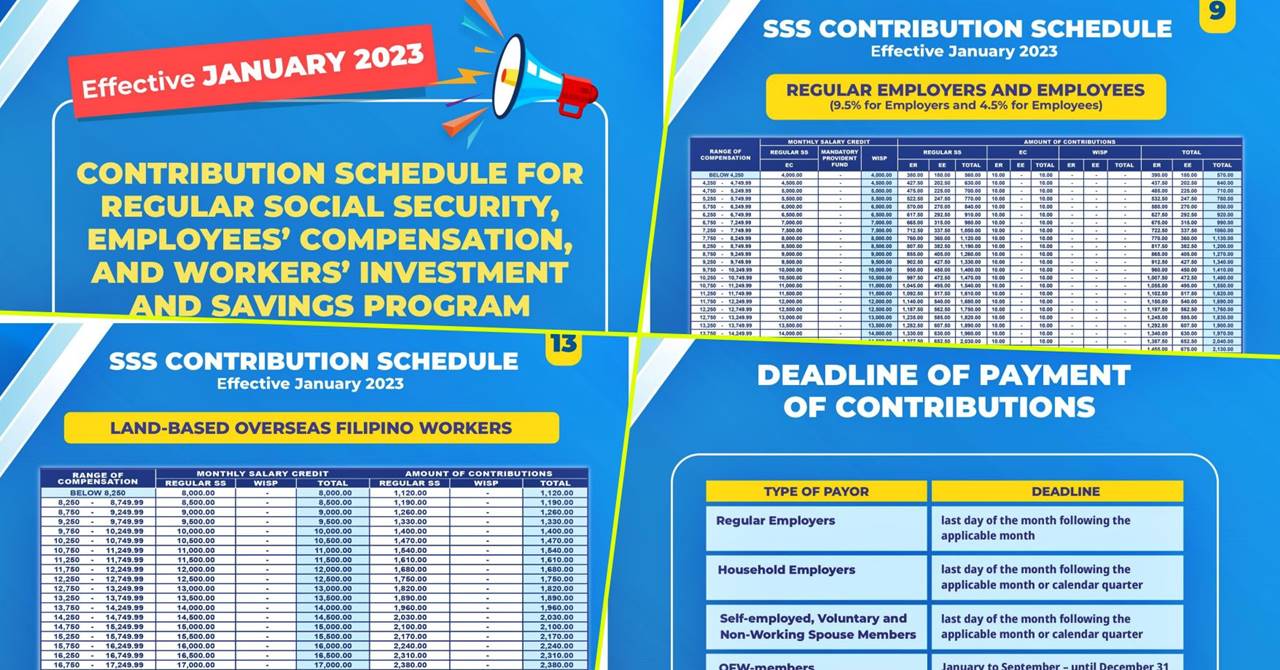

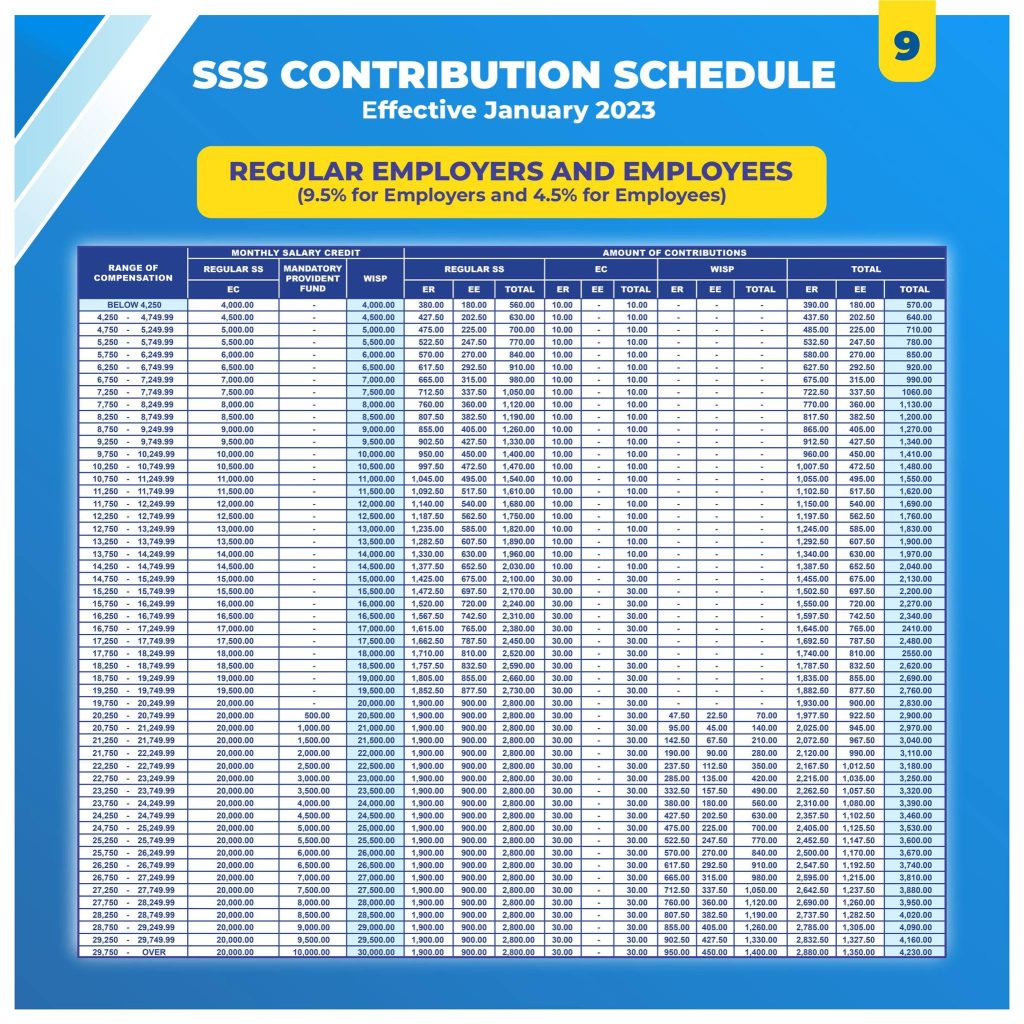

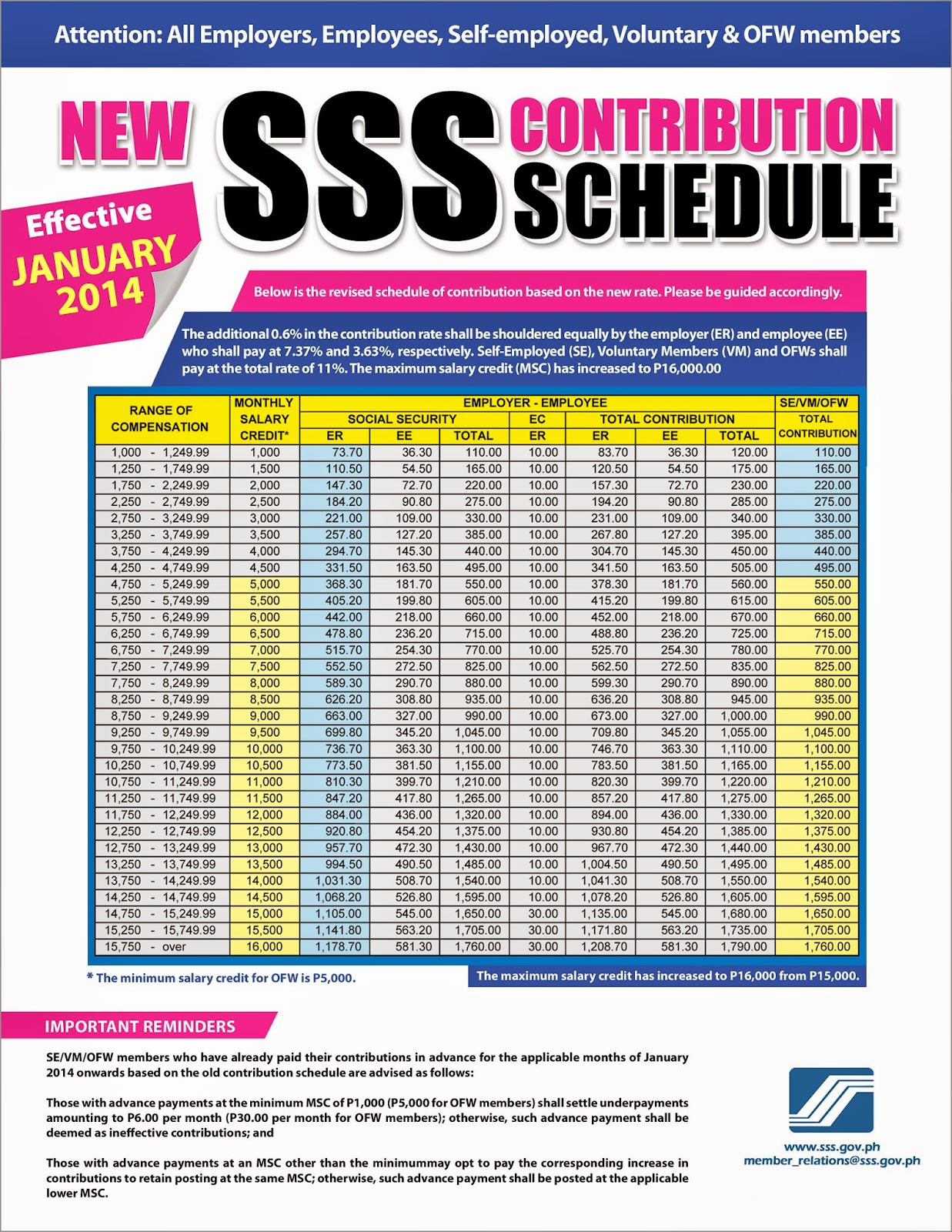

effective year 2023, the new schedule of contributions of ER and EE is hereby issued and shall be effective for the applicable month of January 2023 as per Social Security Commission (SSC) Resolution No. 751-s.2022 dated 25 November 2022. The table below reflects the contributions for SS, the Employees' Compensation (EC) and the Workers'

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

Starting in 2024, the monthly contribution rate for Pag-IBIG will increase from 1% to 2% of the employee's monthly compensation. The agency also plans to raise the Monthly Fund Salary from P5,000 to P10,000 for 2024. Consequently, members will now contribute P200 monthly, with employers matching this amount.

GUIDE SSS Contribution Table 2023 WhatALife!

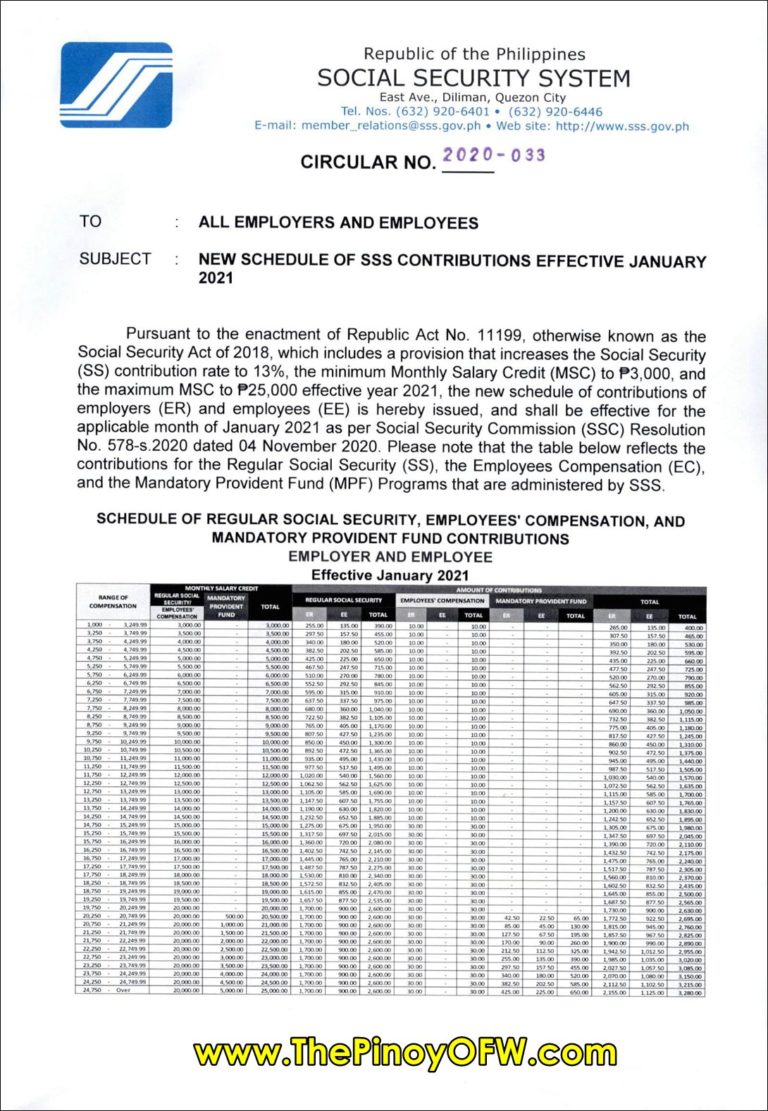

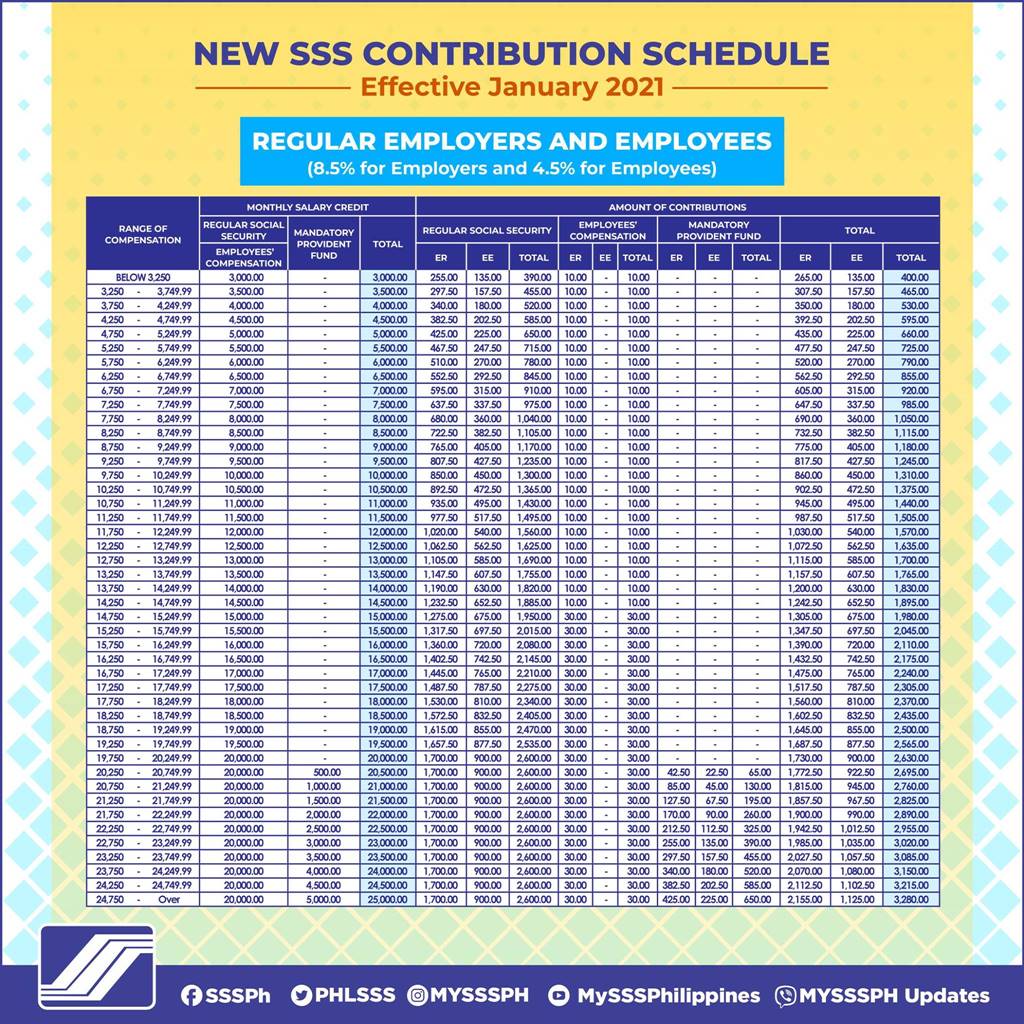

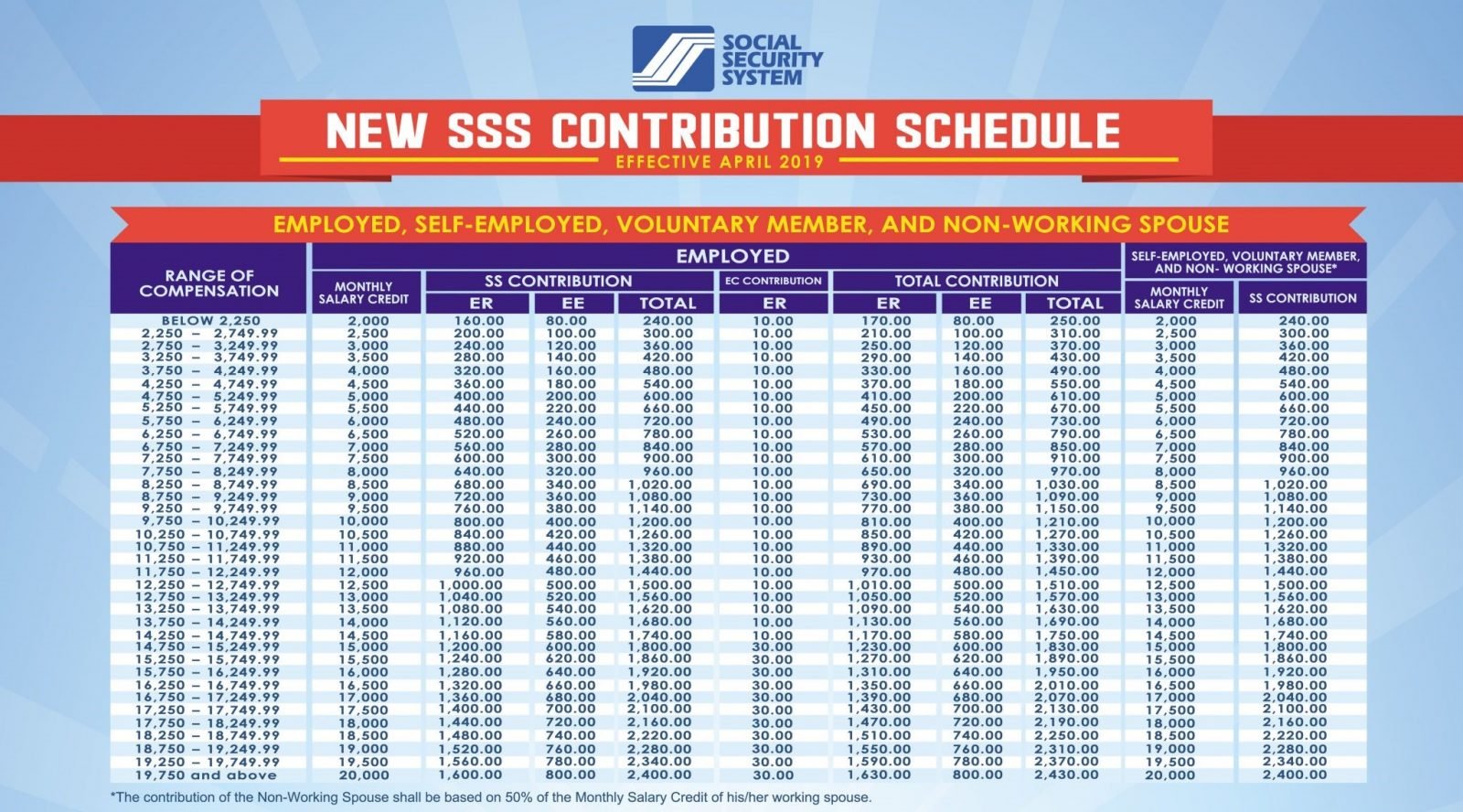

The new SSS Contribution table for voluntary and non-working spouse has been updated this 2021. It's current minimum compensation range is set to ₱3,250 with a total contribution of ₱390. Meanwhile, the maximum compensation range is pinned at ₱24,750 with a total contribution of ₱3,250.

SSS Contribution Table 2023 Here's Guide on Members Monthly

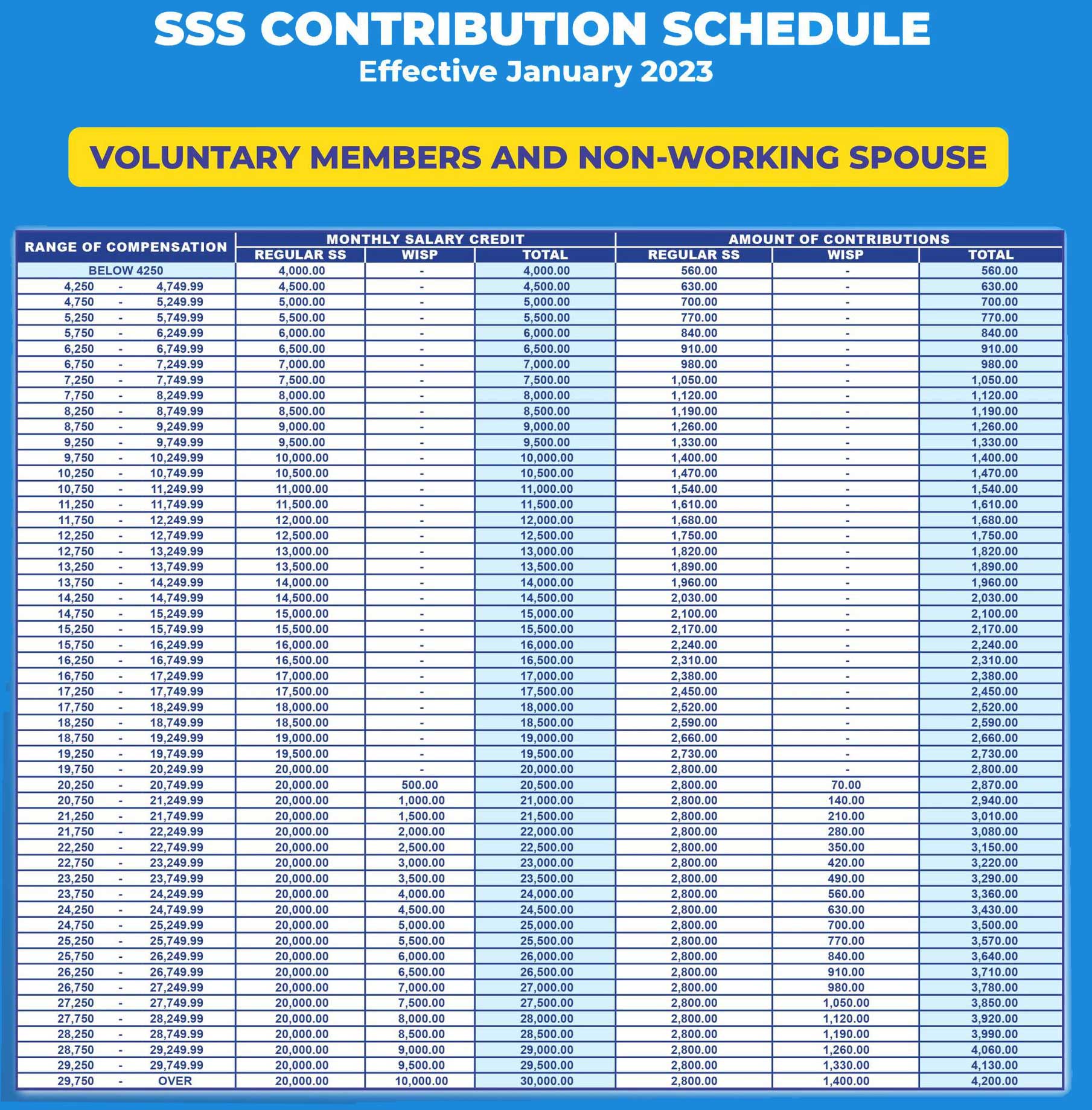

ALL VOLUNTARY AND NON-WORKING SPOUSE MEMBERS NEW SCHEDULE OF SOCIAL SECURITY (SS) CONTRIBUTIONS EFFECTIVE JANUARY 2023 Pursuant to Republic Act No. 11199, otherwise known as the Social Security Act of 2018, which includes a provision that increases the SS contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximu.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

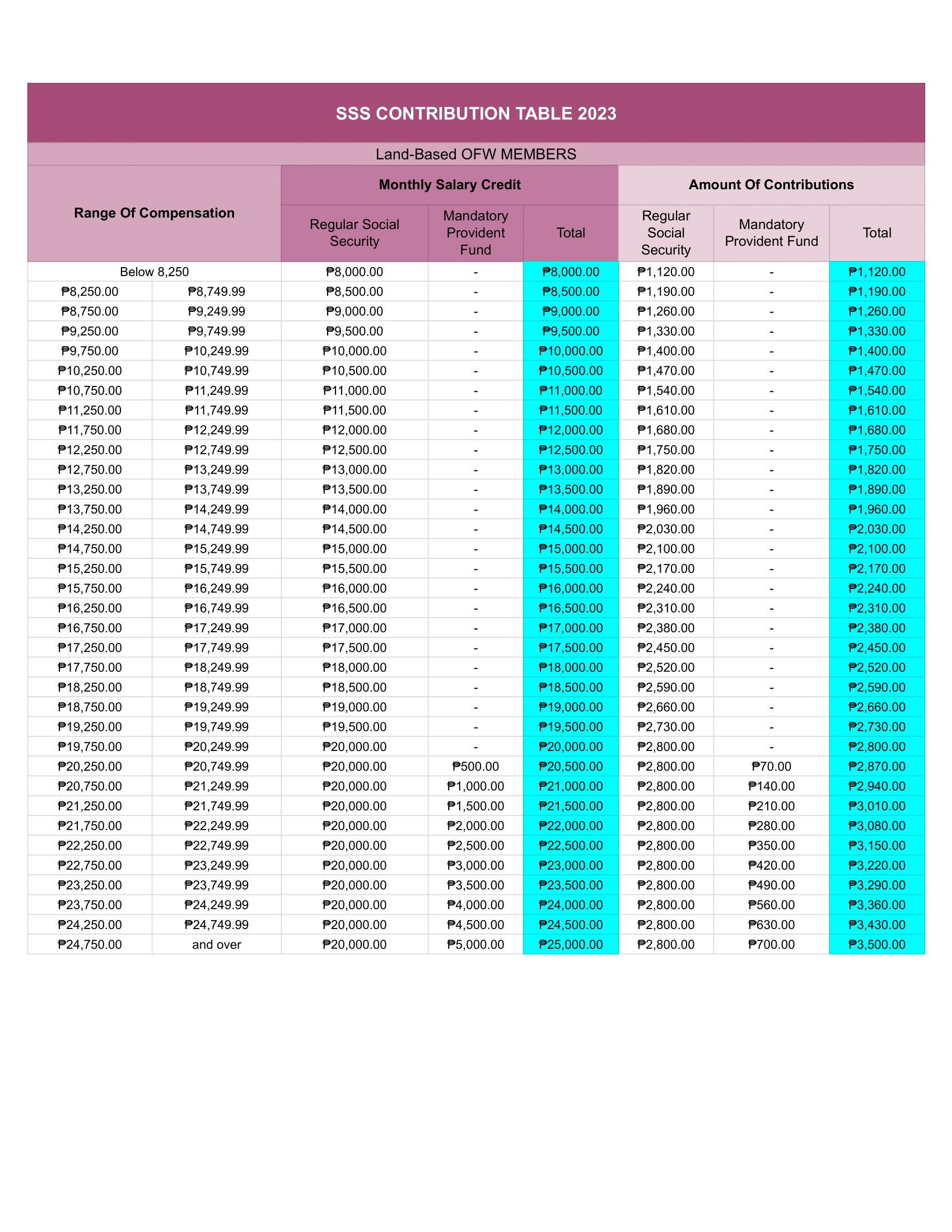

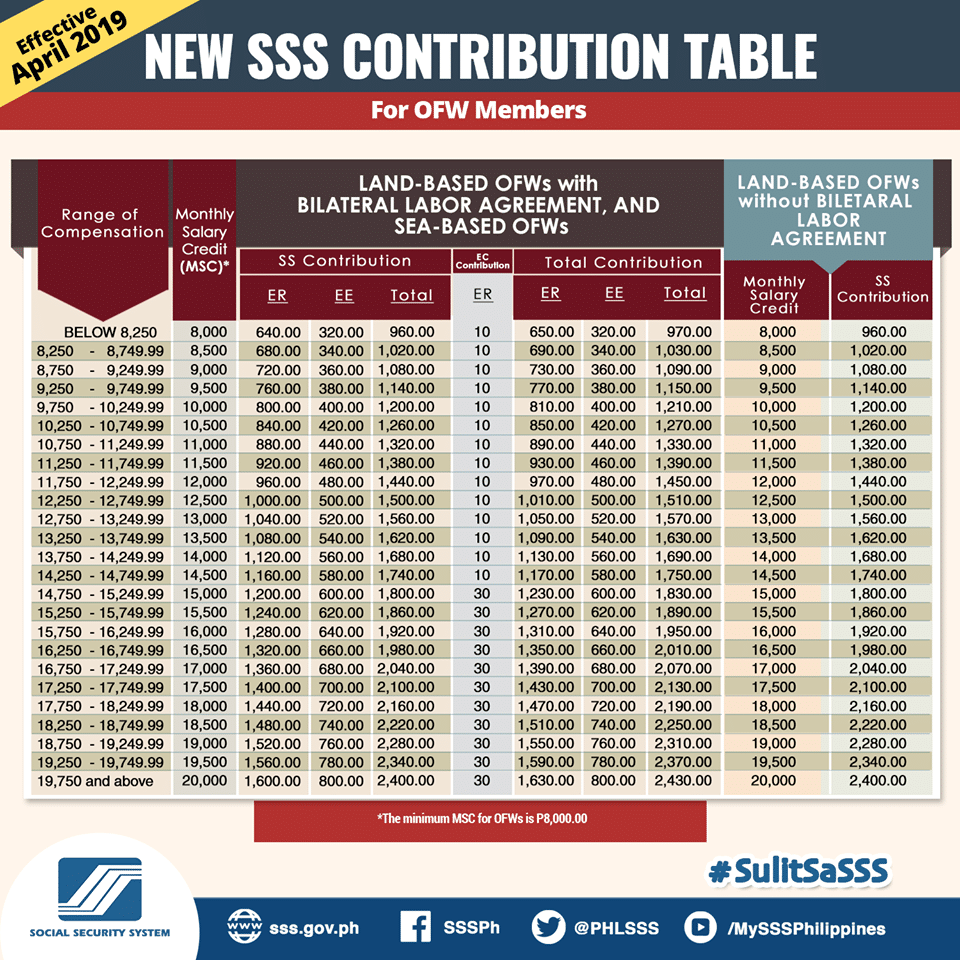

Why Pay Your Contribution Regularly? How To Compute Your Monthly SSS Contribution: The Basics The New SSS Contribution Schedule The 2023 SSS Contribution Table 1. Employed Members 2. Self-employed Members 3. Voluntary and Non-Working Spouse Members 4. OFW Members 5. Household Employers and Kasambahay Tips and Warnings 1.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

The SSS contribution table for voluntary and non-working spouses is a guide that outlines the monthly contribution rates for those not required to pay mandatory SSS contributions. This includes voluntary members who have chosen to enroll in the SSS program, as well as non-working spouses of SSS members who are not gainfully employed.

SSS Voluntary Contribution How Freelancers Can Pay ModernFilipina.ph

Employee Monthly Contribution: New SSS Contribution Table for 2023 2023 Update: Based on SSS Circulars No. 2022-033, 034, 035, 036, and 037 signed by SSS President and CEO Michael G. Regino, the contribution rate for 2023 is 14%, which is one percent higher than for the previous year.

New sss contribution table 2023 Artofit

Significant Features of the 2023 Contribution Schedule Employees For Employers (ER) and Employees (EE) contributing at an MSC of ₱20,000 and below: Additional monthly SSS contributions range from ₱40 to ₱200, which will be paid by the employer only. For ER and EE contributing at the maximum MSC of ₱30,000:

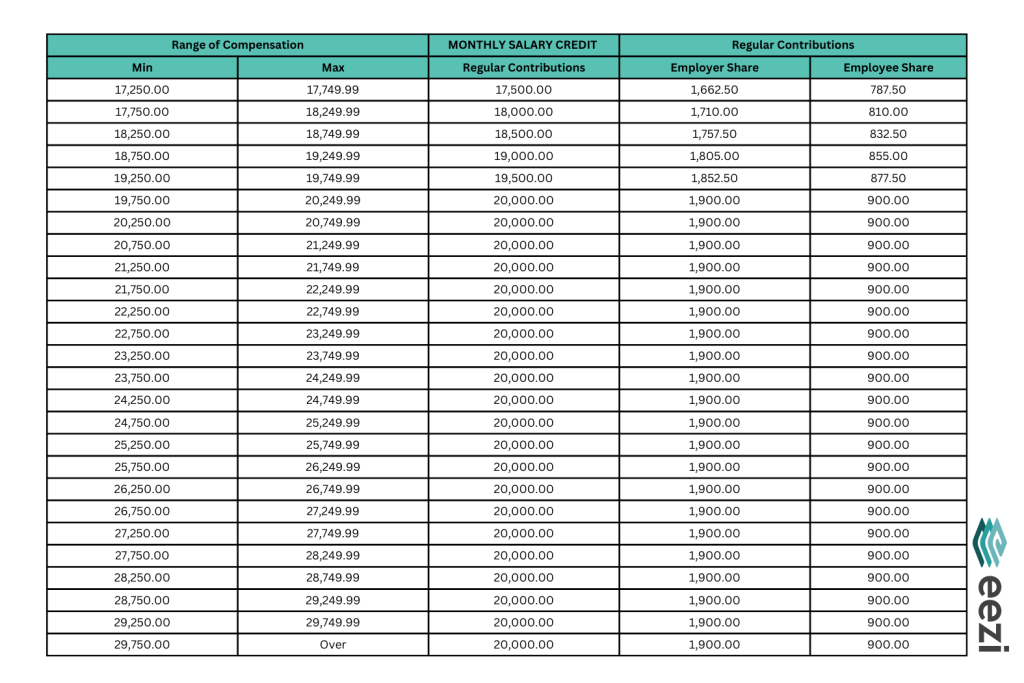

How to Compute Our SSS Monthly Contribution 2022 & 2023 eezi

Easily calculate your monthly contributions based on your income and employment status. Our user-friendly calculator will help you determine your contribution and provide you with a breakdown of your monthly contribution based on your salary range. The SSS table is regularly updated to ensure that you have access to the most current rates.

SSS Voluntary Members Contribution Table 2023

Below is the SSS monthly table of contributions schedule starting January 2023 for Voluntary Members and non-working spouses: For Voluntary Members/Non-Working Spouses, the minimum and maximum total monthly contributions are PHP 560.00 and PHP 4200.00, respectively. 2023 SSS Monthly Contribution for Household Employers and Domestic Helpers

SSS Contribution Table 2023 Voluntary, Self Employed, Kasambahay, and OFW

New SSS Contributions Effective 2023 Updated: May 15, 2023 Pursuant to Republic Act No. 11199, otherwise known as Social Security Act of 2018 which includes provision that increases the SSS Contribution rate effective January of the year of implementation as follows:

How to Compute for SSS Contribution « EPINOYGUIDE

Here is the Voluntary Contribution SSS 2023/2024 Table and how to check your required monthly contribution as an employee in Philippines. Every year, the Social Security System publishes a payment plan outlining the mandatory monthly contributions for both workers and employers. Employees are responsible for remitting their monthly contributions either on their own or through.

SSS Contribution Table 2023 What's New? Para sa Pinoy

VOLUNTARY MEMBER & NON-WORKING SPOUSE RANGE OF COMPENSATION MONTHLY SALARY CREDIT AMOUNT OF CONTRIBUTIONS. Members who have already paid their contributions in advance for the applicable months of January 2023 onwards based on the old contribution schedule are advised as follows: 1. Those with advance payment at the minimum of ₱3,000.00.

Download 2023 SSS Contribution Table and Schedule of Payments Watch online

The SSS Contribution Table helps Voluntary, Self Employed, and OFW members determine the monthly contribution amount they have to pay with SSS. The Chart guides regular employees to know the percentage of contribution payments they have to share with their employers.